The global COVID-19 pandemic has had a far-reaching impact. Beyond the tragic implications for health and wellness, the response to the pandemic has created the worst economic crisis since the Great Depression, a decline that may take years or decades to recover from. In the wake of its ruin and record levels of unemployment across the U.S., many workers in their 50s and 60s are being forced to retire early as a result of the pandemic.

In thinking about retirement, one of the biggest mistakes people make in their golden years is retiring too early and tapping into their retirement savings ahead of schedule. It’s possible to make a number of hasty decisions on the path to retirement, particularly during an economic downturn, that can leave you in a vulnerable financial position during what should be some of the best years of your life.

For a closer look at some of the money mistakes people make in their golden years, we surveyed over 1,000 people over 50 about their current financial situations and some of the decisions they’re making for the future. Read on as we explore how many Americans over the age of 50 are still working and why; how much debt they have; and which mistakes they might have made in their 20s and 30s that are still having a long-term impact on the road to retirement.

Working Over the Age of 50

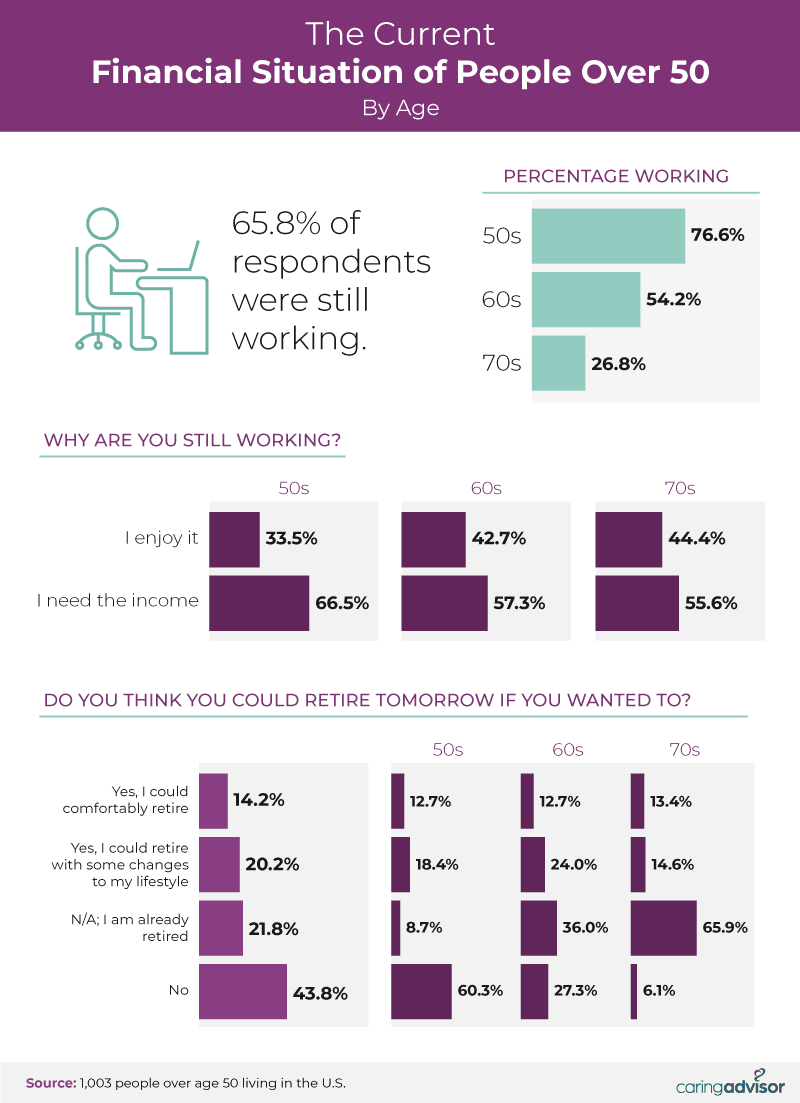

Among our respondents, 66% said they were still working, including 77% of people in their 50s, 54% of people in their 60s, and 27% of people in their 70s.

Among those in their 50s, nearly 34% said they were still working because they enjoyed it, but almost 67% indicated they needed the income. In contrast, people in their 60s (43%) and 70s (44%) were more likely to report being employed because they enjoyed working, albeit 56% of Americans in their 70s said they were still working because they needed the income.

COVID-19 has forced as many as 4 million Americans to retire early as a result of shutdowns, layoffs, and furloughs. Just 14.2% of people said they could comfortably retire tomorrow if necessary, and another 20% said they could retire if they had to with some changes to their lifestyle. Unfortunately, 43.8% of Americans indicated they would be unable to retire tomorrow, even if they wanted to, including 60.3% of people in their 50s, 27.3% in their 60s, and 6.1% of Americans in their 70s.

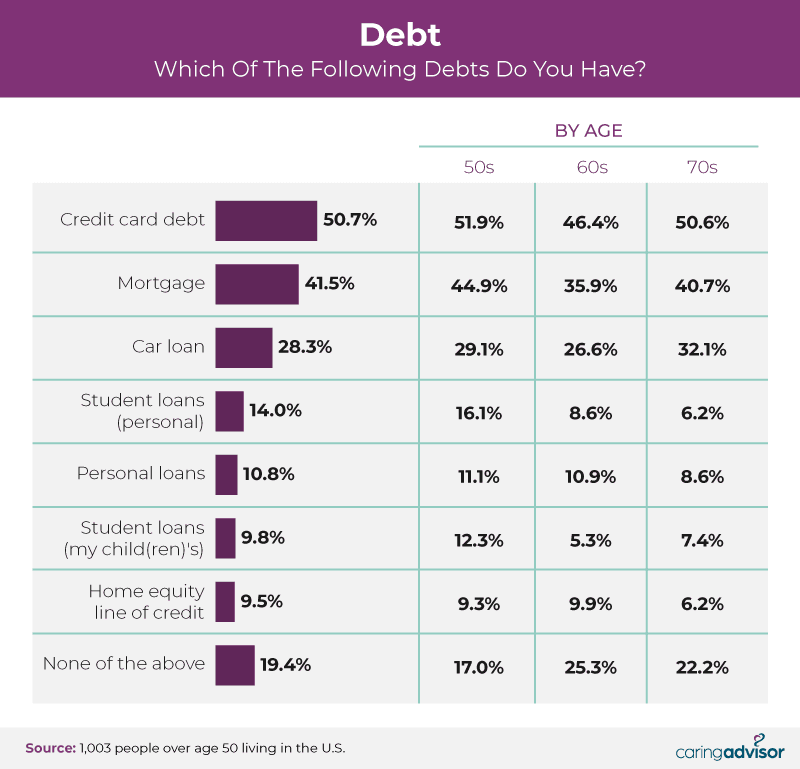

Perhaps one of the reasons people over the age of 50 were still working or unable to retire was a result of debt. Fifty-one percent of respondents said they had credit card debt, followed by a mortgage (41.5%), a car loan (28.3%), and personal student loans to pay off (14%). Debt was generally more common among people in their 50s compared to those in their 60s and 70s, including 51.9% who had credit card debt, 44.9% who had a mortgage, and 16.1% who still had their student loans to pay off. Still, nearly 51% of people in their 70s said they had credit card debt to pay off, and 40.7% were still making mortgage payments on their home.

Money Missteps Made While Young

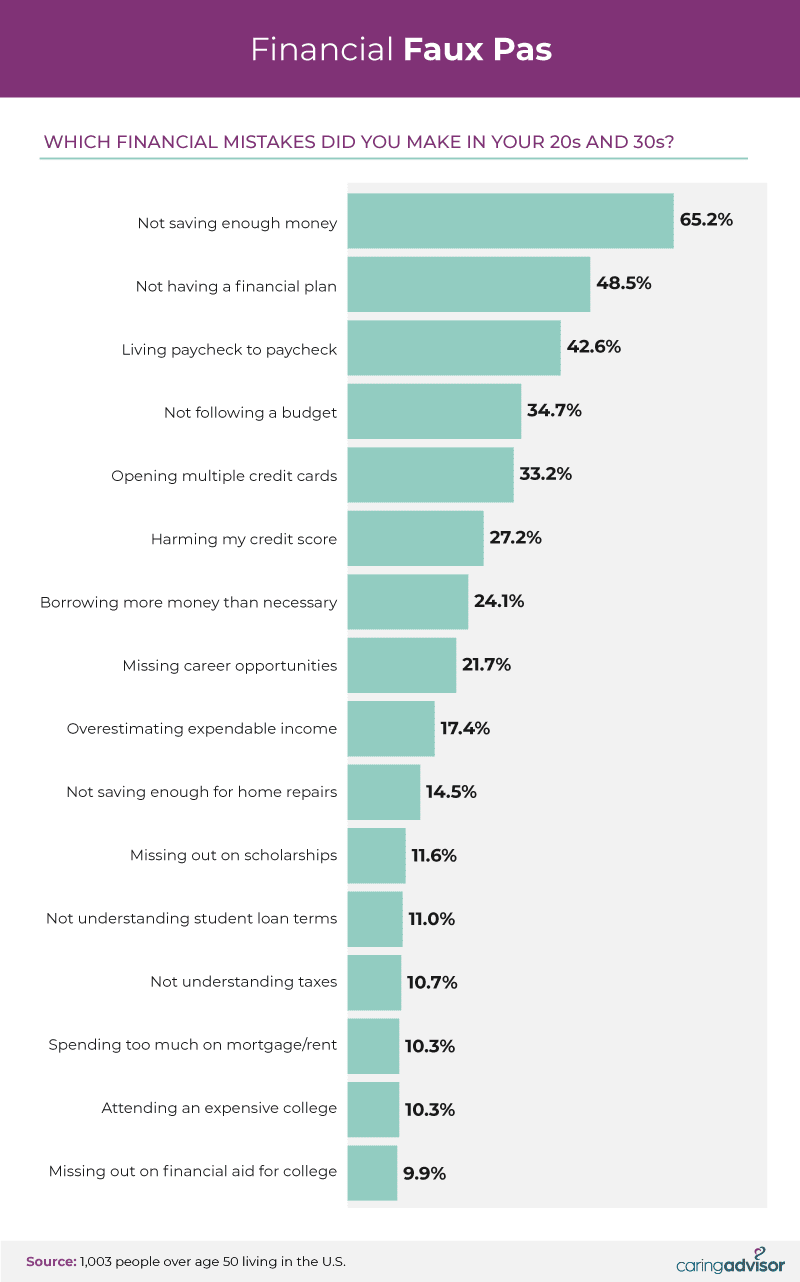

For many seniors over the age of 50, their current financial predicament might be a result of mistakes they made in their 20s and 30s. Sixty-five percent of people over the age of 50 said they didn’t save enough money in their 20s and 30s, and almost 49% said they didn’t have a financial plan when they were younger. According to some experts, you should be saving 15% of your pretax income every year to put toward retirement by the time you’re in your late 20s or early 30s. The longer you wait to start saving, the more you’ll need to save or the later you’ll be able to retire.

While slightly less common, 42.6% of respondents said they made the mistake of living paycheck to paycheck when they were young, and 34.7% admitted they failed to follow a budget. Just shy of one-third of people polled also identified making the mistake of opening multiple credit cards (33.2%), and more than a quarter cited doing things that harmed their credit score (27.2%).

Financial Faults

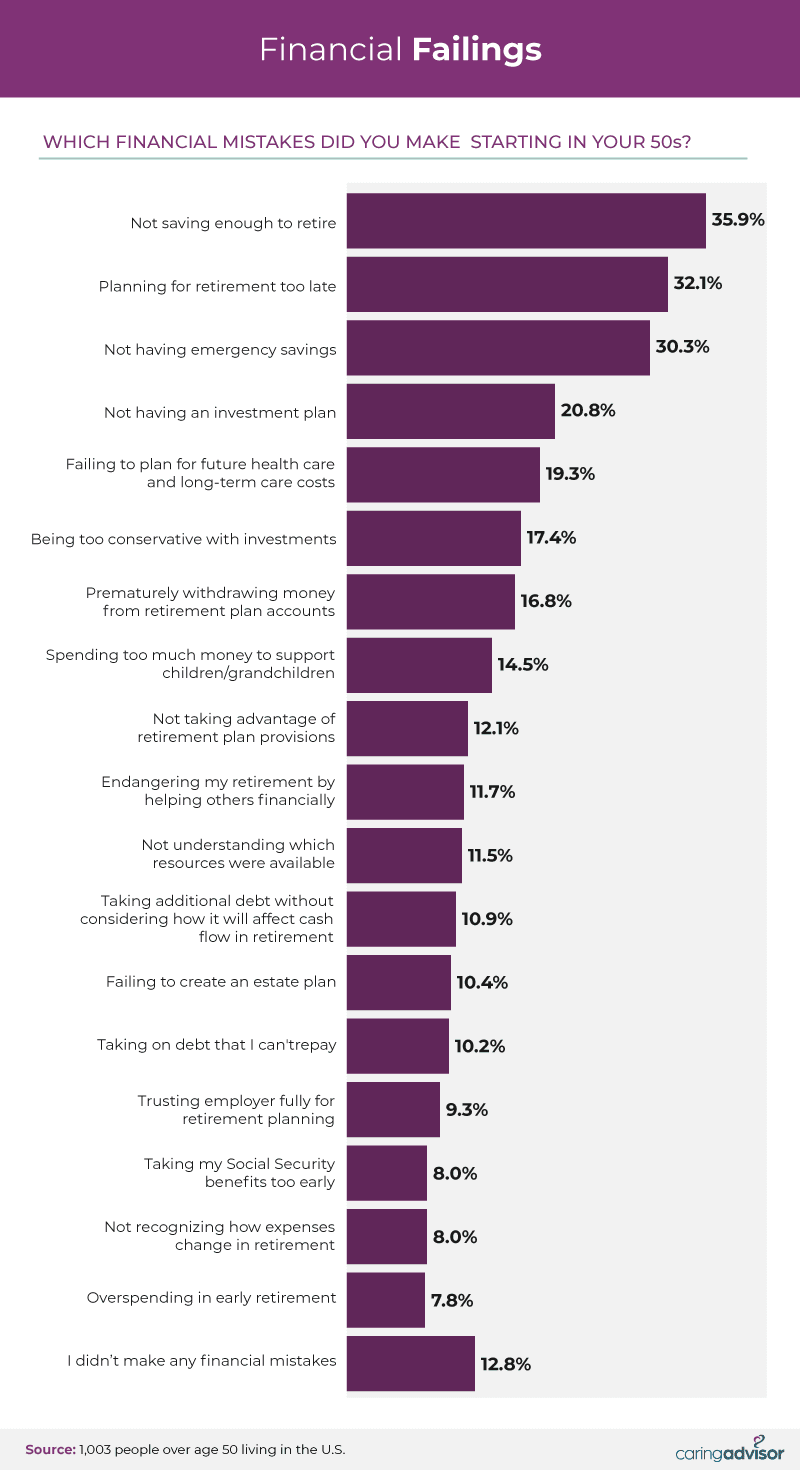

Mistakes weren’t specific to their younger years, though, and people over the age of 50 indicated the missteps that happened in their golden years too. More than a third of respondents, 35.9%, said the biggest mistake they made starting in their 50s was not having enough savings to retire, followed by starting to plan for retirement too late in their life (32.1%) and not having enough money in emergency savings (30%). More than 1 in 5 respondents (20.8%) indicated not having an investment plan as one of the most common mistakes they made starting in their 50s, and nearly as many said the same about failing to plan for their future health care or long-term care costs (19.3%).

“Life zips by – even if it’s only a minimal amount, start putting money every two weeks into the best savings plan available and evaluate three times every expenditure considered before spending the money.” — 74-year-old man

Among older Americans, 21% of people in their 70s admitted they overspent in the early part of their retirement, and 16% acknowledged they didn’t know how their expenses would change after they retired. Retirement isn’t a repeat experience, so it can be hard to accurately predict the expenses you’ll encounter when you get there. For some people, input from a financial adviser can help them more correctly anticipate (and save for) medical expenses and cost of living in retirement.

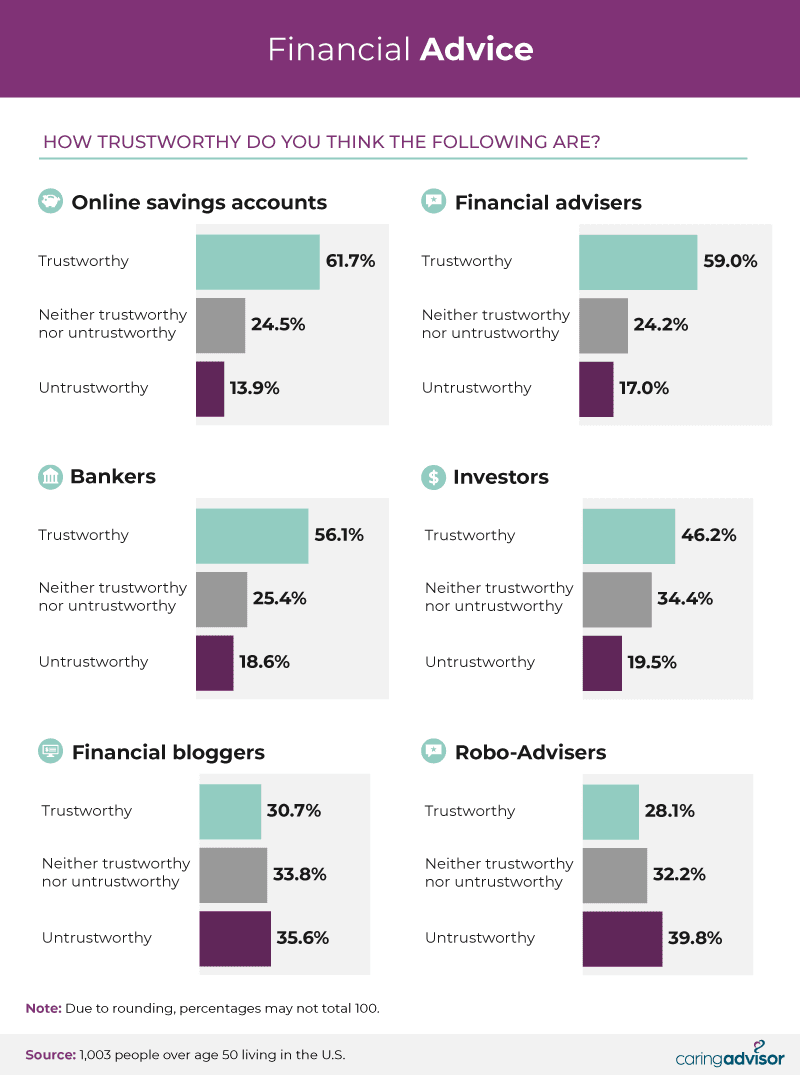

Which Financial Advisers to Trust

Every retirement plan is personal and unique, but that doesn’t mean you have to build it by yourself. Finding an adviser or expert you trust can help you plan for the future to get the most out of retirement. More than any other kind of expert, respondents said they found financial advisers trustworthy (59%), followed by bankers (56.1%) and investors (46.2%).

“I would have found a good counselor or mentor to help me determine a career path that is suitable for me. I didn’t have any career or financial guidance early on, and I made life-changing errors.” — 60-year-old woman

And while working with a financial adviser can come with its own costs, research indicates the return on that investment more than makes up for the out-of-pocket expense. In contrast, robo-advisers (39.8%) and financial bloggers (35.6%) were considered the most untrustworthy sources for expert advice or opinions by those surveyed.

The Pandemic’s Impact

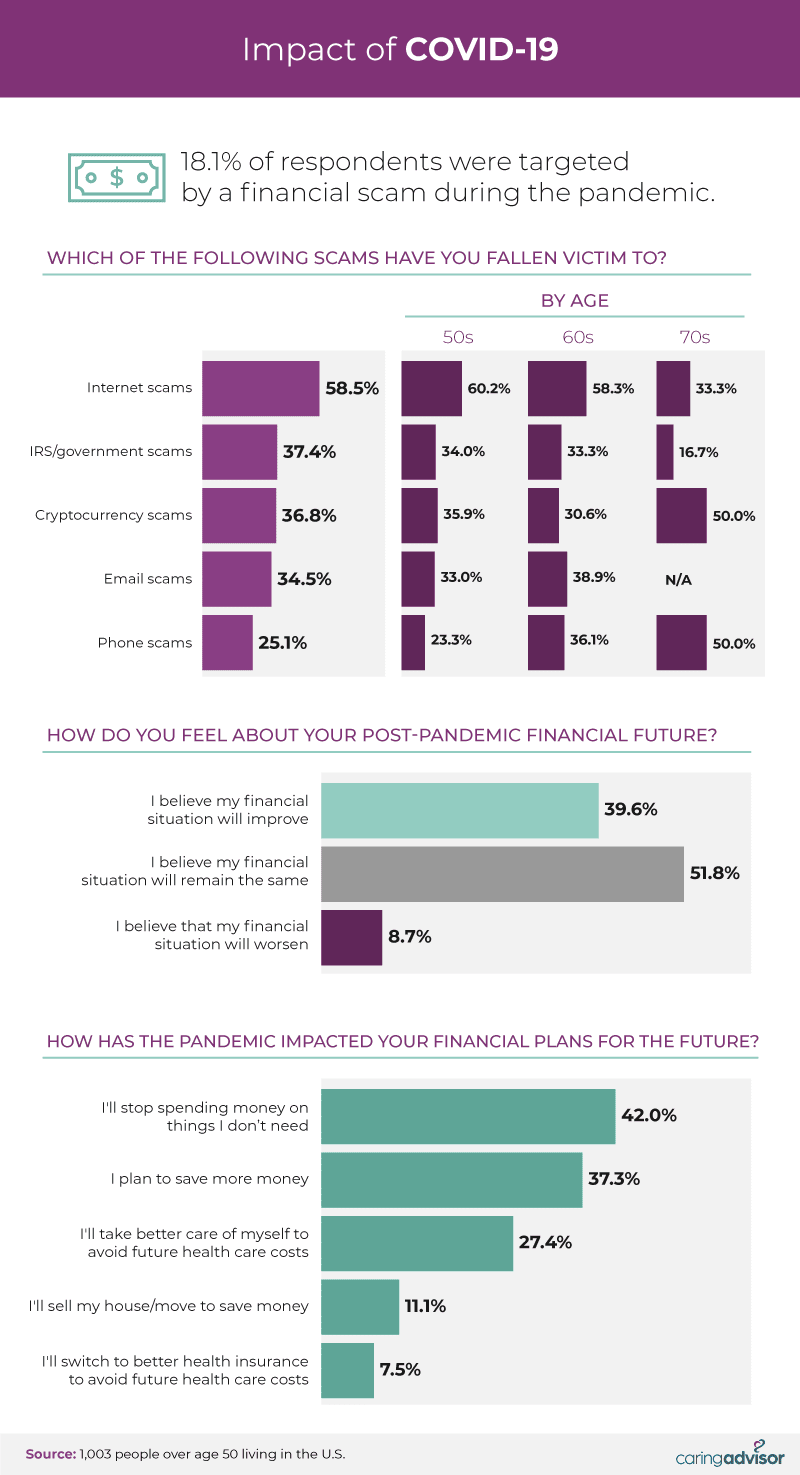

Trustworthiness matters in who you turn to for advice or support during retirement, particularly where finances are concerned. Eighteen percent of people over the age of 50 reported being targeted by a financial scam during the pandemic. Fifty-eight percent of respondents also acknowledged having fallen victim to an internet scam at some point, followed by an IRS or government scam (37.4%), cryptocurrency scams (36.8%), and email scams (34.5%). People in their 50s were the most likely to be victimized by internet scams (60.2%), while people in their 70s were the most likely to be impacted by cryptocurrency and phone scams (50% each). In 2019, cryptocurrency scams took more than $4 billion from unsuspecting victims.

A majority of respondents also believed their financial situation will stay the same after the COVID-19 pandemic has passed, and 39.6% anticipated their finances will improve. In comparison, 8.7% of people over 50 expect their financial situation to worsen after the COVID-19 pandemic has ended. In response to the pandemic, 42% of respondents planned to stop spending money on things they didn’t need, and 37.3% hoped to save more money in general. More than 27% of people over the age of 50 said the pandemic had changed the way they planned to take better care of themselves to avoid health care costs in the future.

Planning for the Future

Planning for retirement can be overwhelming, and understanding how to spend your savings once retirement begins can be even more complex. You have to ensure you’re saving enough when you’re young and not overspending in the early years of retirement once you get there. As we found, many Americans over the age of 50 couldn’t retire tomorrow if they wanted to, and a majority (including those in their 60s and 70s) still working rely on that income to cover their daily expenses.

At Caring Advisor, we know how important it is to build trust within your retirement community. We believe in helping everyone find a place they’ll love with care options that fit their life. From independent living solutions to assisted living and nursing homes or memory care, we’ll help you find the best options for you or someone you love. Even if you’re not sure where to start, our resource library will help you find your way. Start exploring options you can trust online at CaringAdvisor.com today.

Methodology and Limitations

This study used data from a survey of 1,003 people located in the U.S. who are over the age of 50. Survey respondents were gathered through the Amazon Mechanical Turk and Prolific survey platforms where they were presented with a series of questions, including attention-check and disqualification questions. 55.9% of respondents identified as male, while 44.1% identified as female. The average age of respondents was 60 with a standard deviation of six.

Please note that survey responses are self-reported and are subject to issues, such as exaggeration, recency bias, and telescoping.

Fair Use Statement

Money mistakes can happen at any stage in life, but they have the potential to create long-term impacts, even into our golden years. We encourage you to share the results of this study with your readers for any noncommercial use with the inclusion of a link back to this page as credit to our contributors for their work.